Where can I see copies of the City’s operating budget?

Copies of the budget can be viewed on the Current & Prior Year Budgets web page.

What is the City’s budget?

The budget is one of the most important documents in the City. It guides how the City will spend public funding and outlines the priorities of the City. Costs for everyday services such as trash pickup, street resurfacing, police and fire services, parks and recreation, and water and sewer services are included in the budget.

Where can I get an overview of the current budget?

The budget office web site provides a summary of the budget with comparisons to previous years budget. The budget public hearing presentation includes highlights of changes to the budget.

How is the City budget developed?

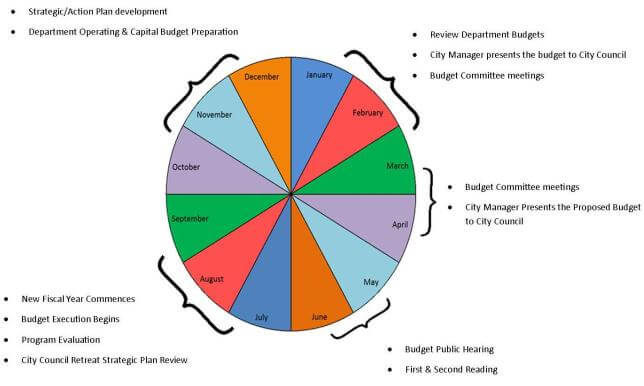

The City’s finances operate on a fiscal year rather than a calendar year. The City’s fiscal year runs from July 1st through June 30th. The City’s ordinance states that the City Manager must present a balanced budget to City Council. The City Council must approve the budget before the end of the fiscal year.

The annual budget process commences during late summer/early fall. A budget calendar is developed which establishes the exact timelines for the process, including dates for submission of departmental requests, budget work sessions and public hearings that lead to final adoption of the budget. An estimated budget cycle is shown below.